In this very young XIXth century, the moribund economy post Revolution urged the First Consul Napoleon Bonaparte to create the Bank of France January 18th, 1800 to promote the economic recovery of the country. The thrifty Napoleon wanted to create a stable and strong value in the heart of an institution that should not serve as a fund to the state but to promote its businesses.

A Stormy Political and Economic Context

The XVIIIth century was not beneficial to paper money. Scalded by the financial scandal of John Law (1671 – 1729) in 1720, the French had plenty of time to confirm their aversion to printed money when they were fooled a second time with brandishing revolutionary assignats that were nothing else than a lightning and spectacular inflation. Some, however, got rich. Among them, the Swiss financier Jean-Frédéric Perregaux (1744 – 1808). Precisely preceding the perpetual neutrality that will later make the pride of his native Switzerland, our Helvetian, who, before the Revolution, mixed with the world’s most popular aristocratic circles, was careful not to display too clearly his political opinions during the brutal change of regime. He preferred, as many at that time, to adapt them to the necessities of the moment. It was certainly the right move since the members of the nobility – fiercely attached to their heads – were quick to flee abroad taking care to carry with them a considerable part of the metal currency of the late Kingdom of France. A financial crisis hit the people, who – having nothing to fear for their own head – had everything to fear for their finances. In an extremely unfavorable economic climate, bankruptcies were numerous and internal trade paralyzed. The Directory was unable to remedy the problem in a sustainable way and it was not until the Brumaire coup (November 9-10th, 1799) to see the emergence of hope for a government stability essential to an economic recovery of the country. It was then that our dashing Swiss banker approached Bonaparte, the context and Napoleon smiling at him in concert.

Perregaux and a few banker friends (Le Couteulx, Mallet and Perier) first obtained the right to print bank notes for their own establishment named Caisse des Comptes Courants. They aim to collect the savings then hoarded by individuals and increase the amount of money in circulation. The Banque de France was created on 18th January 1800 by decree and quickly absorbed the Caisse des Comptes Courants. The very young Banque de France settled in the Hôtel de Toulouse, rue de la Vrillière in Paris, of course.

The first Consul wanted to be cautious and wanted to guarantee the stability and reliability of this new institution. The first issues of notes were thus guaranteed to find their equivalent in quantity of gold of the same value to any person who wished it. To proceed to the exchange, one should simply go to the Rue de la Vrillière. It was all about the reputation of the bank and its future, the first Consul was perfectly aware. The French, who enjoyed nothing less than being fooled three times in a row, were at first extremely suspicious. Then little by little, confidence returned. It must be said that Bonaparte’s personal, hard-hitting and irresistible involvement had something to do with this success. He placed some of his own funds in trust with the Bank and persuaded his family and relatives to do the same. The transaction, together with the capital contributed by wealthy shareholders, provided the institution with considerable capital, which was necessary to establish its essential importance. Soon, the Bank of France was the only bank authorized to issue monetary values hence its name “central bank”.

The main clients of the bank were ordinary banks, whose business was to lend money to individuals and businesses. The principle was therefore based on the promise of repayment made by the borrower to his banker, a promise referred to as a “bill of exchange”. At the same time, ordinary banks needed money to lend to new customers. They needed to have sufficient financial reserves to act without waiting for borrower clients to repay their debts. Ordinary banks turned to the Banque de France and bought him notes in exchange for the bills of exchange they had at their disposal. Naturally, the amount of money increased in the country and allowed to revive commerce and industry. In turn, the latter made profits that were inevitably taxed. Finally, the increasing value of taxes levied by the state allowed the country to get rich and the First Consul to finance his army (and not his campaigns).

The Franc Germinal, a Reliable Economic Value

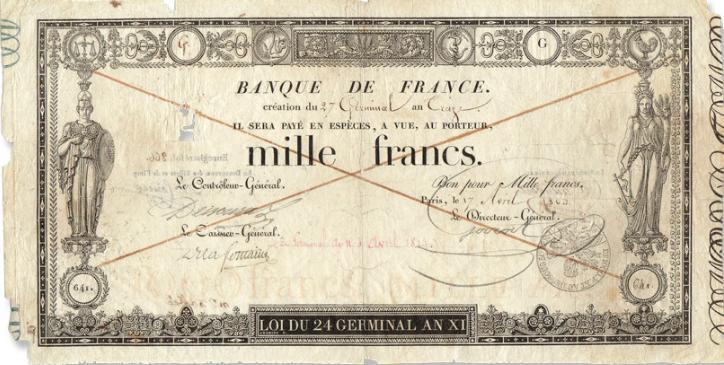

The first notes issued by the Bank of France were of such value that they were not accessible to all. The 500-franc notes represented a little more than a year’s salary for a worker, and that of 1000 was equivalent to double the work, naturally. Not being convertible into gold elsewhere than in Paris, the notes further restricted the circle of lovers of bundles. These notes occupied so well the only high Parisian business that they had confused any merchant if a citizen would have the idea to give one of these papers to pay for a chicken (not far from becoming Marengo).

On the other hand, the memory of John Law and the revolutionary assignats remained tenacious, and the French countryside still preferred metallic values for their trade. The Revolution, by a law of August 15th, 1795 had already decided to replace the livre tournois by the “franc d’argent” but its will alone was not enough. Indeed, the fiery and first Republic had that in common with Josephine de Beauharnais (1763 – 1814) at the same time that no one had enough money – metal for one, ready for the other – to satisfy their needs. It was thus necessary to wait for the 7th germinal year XI (March 28th, 1803) to see reappear this franc which borrowed at its date of creation the name under which it will exercise until 1928 namely, the franc “germinal”.

Do you like this article?

Like Bonaparte, you do not want to be disturbed for no reason. Our newsletter will be discreet, while allowing you to discover stories and anecdotes sometimes little known to the general public.

Congratulations!

You are now registered to our Newsletter.

Manufacturing and Security of Monetary Values

The first two banknotes put into circulation by the Banque de France represented considerable sums. From then on, everything had to be done to prevent as much as possible the appearance of false. The paper was first produced at the stationery of Buges in Loiret but it was quickly preferred that of the paper mill of the Marais at Jouy-sur-Morin. The addition of a watermark between the two sheets of paper constituting each note was one of the first security provisions. Then came the quality of the drawing for which Charles Percier (1764 – 1838) was called upon. This neoclassical architect who had distinguished himself in his achievements for financiers working alongside the First Consul was not long to be warmly recommended to the latter who praised his talents for a long time. The engraving of the matrix was entrusted to Jean-Bertrand Andrieu (1761 – 1822) who took as a support a steel plate to guarantee an inking always equal. Finally, the engraving typography returned to Firmin Didot (1764 – 1836) whose name is still well known today by lovers of prints and old editions. A stub was added, a dry stamp (embossing the paper obtained with a press) and a wet stamp (a technique for printing simultaneously on the front and back).

As for the symbolism of the chosen motifs, we find the strong influence of the Roman Empire (tinged with the neoclassical taste born from the excavations of Herculaneum and Pompeii in the XVIIIth century). Compass and square evoke the tools of the builders using geometry and architecture, while the rooster emblem of France rubs shoulders with the scale of Justice. The divinities represented are those that the great estates considered as constituting a strong state in the XIXth century: Vulcan for industry, Apollo for the arts, Ceres for agriculture and Poseidon for the colonial empire.

Metal coins are subject to the same concerns, both security and symbolism. The Republican motifs were replaced at the obverse of the pieces by Bonaparte’s bare-headed profile – whose engraver, General Pierre-Joseph Tiolier (1763 – 1819) painted the portrait – accompanied by a legend “Bonaparte First Consul”. The reverse was an olive crown, the face value of the coin and the legend “French Republic”. Of course, an imperial proclamation will be enough for the motives of coins and notes to be changed once more.

The creation of the Banque de France had a decisive impact on the country’s economy and its imperial expansion (although it did not finance them, the Emperor always defended it). Paper money improved, gaining security and discouraging counterfeiters. However, in 1959, the Bank of France issued a 100 franc note of Napoleon. This note made famous the forger Czesław Jan Bojarski (1912 – 2003) who made a specialty of the falsification of these “Bonaparte notes”. His mastery in this field is still unchallenged and unmatched. These fakes are now rare and expensive collectibles. An irony of history that certainly did not escape the Emperor if he had been alive to appreciate it.

Marielle Brie de Lagerac

Marielle Brie est historienne de l’art pour le marché de l’art et de l’antiquité et auteur du blog « Objets d’Art & d'Histoire ».